Market Analysis: Seasonal Cooling and Inventory Trends in Collin County (November 2025)

- Brandon Scribner

- Dec 22, 2025

- 3 min read

The Collin County real estate market analysis for November 2025 reveals a seasonal contraction in inventory and sales volume, yet year-over-year gains in availability remain strong. Interest rates have held steady at 6.57%—a figure the data explicitly highlights as "Great News for Buyers"—maintaining a window of opportunity as the year draws to a close.

Here is a deep dive into the key trends across the new construction, resale, and residential lease sectors.

New Construction Market: Seasonal Adjustment & Price Corrections

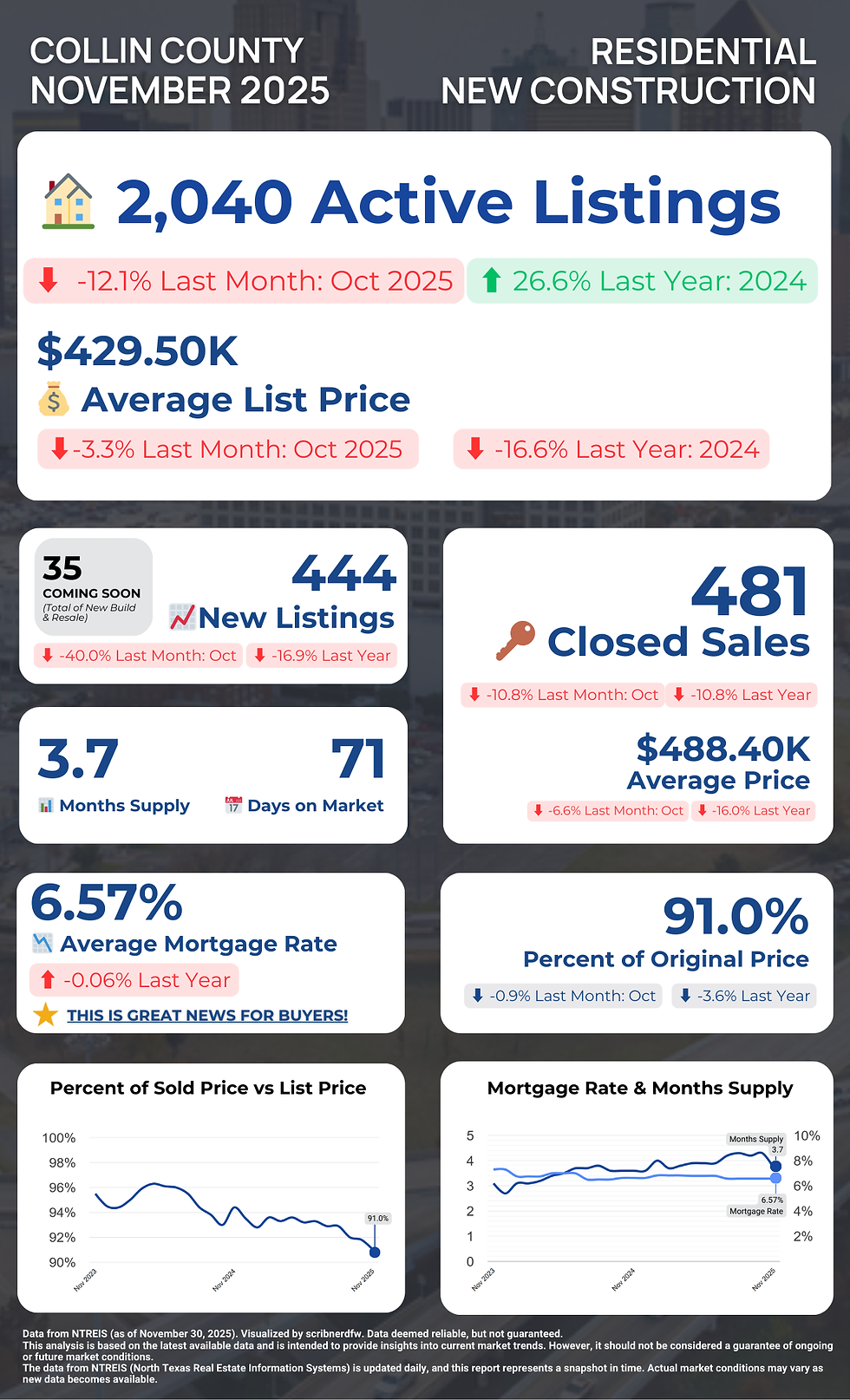

The new construction sector in Collin County saw a notable shift in November. Active listings adjusted to 2,040, marking a 12.1% decrease from October. However, looking at the broader picture, inventory remains robust, sitting 26.6% higher than this time last year. This suggests that while builders are slowing down for the winter, buyers still have significantly more options than they did in 2024.

Pricing dynamics have also shifted. The average list price dropped to $429.50K , while the average closed price came in at $488.40K. This continued gap between list and closed prices indicates that while base prices may appear lower, upgrades and premium lots are likely driving final sales prices higher.

Key New Construction Market Trends:

Inventory Trends: Active listings settled at 2,040, down 12.1% month-over-month but up 26.6% year-over-year.

Price Adjustments: The average list price is $429.50K (down 16.6% year-over-year) , while the average closed price is $488.40K.

Sales Activity: There were 481 closed sales in November, a decrease of 10.8% from the previous month and a 10.8% decrease compared to last year.

Negotiation Power: Sellers are receiving 91.0% of their original asking price, indicating continued and significant room for negotiation for buyers.

Time on Market: New construction properties are averaging 71 days on the market.

Market Supply: The sector currently holds 3.7 months of supply.

Resale Market: Inventory Tightens as Prices Hold Firm

The resale market experienced a sharper contraction in November. Active listings dropped to 3,792, a 10.0% decrease from October. Despite this seasonal dip, inventory remains 16.2% higher than in 2024, preserving a healthy selection for buyers. Interestingly, while volume slowed, the average closed price rose, suggesting that premium homes are still moving or that lower-end inventory is scarce.

Key Resale Market Trends:

Inventory Levels: Active listings stand at 3,792, down 10.0% from last month. New listings slowed significantly to 999, a 29.3% decrease from October.

Price Dynamics: The average list price is $574.42K , while the average closed price is $621.30K. Notably, the average closed price saw a 2.8% increase month-over-month.

Sales Activity: Closed sales dropped to 681, a 22.6% decrease from October.

Market Supply: The resale market currently sits at 4.30 months of supply.

Seller Position: Sellers are receiving 93.7% of their original list price, a slight decrease of 0.3% from the previous month.

Time on Market: Resale homes are averaging 62 days on the market.

Rental Market: Steady Seasonal Cooling

The residential lease market followed the broader seasonal cooling trend. Active lease listings adjusted to 2,662, a 4.1% decrease from October, though inventory remains 13.7% higher year-over-year.

Key Rental Market Trends:

Availability: Active listings sit at 2,662. New lease listings dropped to 1,100, a 15.8% decline from October.

Leasing Activity: Closed leases totaled 779, a 7.7% decrease from the previous month.

Lease Prices: The average listed rent is $2.64K, while the average closed lease price is $2.60K.

Leasing Time: Properties are moving relatively quickly, averaging 52 days on the market.

Negotiation: Landlords are receiving 94.8% of their original listed price.

Overall Market Outlook

November 2025 in Collin County reflects a classic late-year market shift. With the average mortgage rate holding at 6.57%, the financing environment remains stable for buyers. However, the data highlights a clear "quality over quantity" dynamic: while total inventory and sales volume have contracted seasonally across the board, year-over-year inventory levels are still elevated. Buyers currently possess strong leverage in the new build sector (paying ~91.0% of list price) , while the resale market demands slightly more competitive offers (paying ~93.7% of list price) even as choices narrow.

Important Note:

This analysis is based on data from NTREIS (North Texas Real Estate Information Systems) as of November 30, 2025. Market conditions can change rapidly, and this report is intended for informational purposes only. It should not be considered a guarantee of future market performance.