Cooling Trends, Hot Opportunities: DFW Real Estate November 2025

- Brandon Scribner

- Dec 8, 2025

- 3 min read

Based on the November 2025 market report, the Dallas-Fort Worth (DFW) real estate market continues to present conditions that are great news for buyers. The market is seeing a cooling in closed sales across the board compared to October, while inventory levels show mixed signals—tightening slightly month-over-month but remaining higher year-over-year in key sectors.

🏠 New Construction Market: Prices & Sales Cool Down

The new construction sector in DFW experienced a decrease in active listings compared to October, but inventory remains higher than last year. There are now 8,799 active listings. Both the average list price and the average sales price have decreased, signaling potential opportunities for buyers to negotiate.

Key New Construction Market Trends:

Active Listings: 8,799, a decrease of 7.8% from October 2025 but an increase of 4.1% from last year.

Average List Price: $446.85K, down 3.5% from last month and 3.9% from last year.

Closed Sales: 1,725, a decrease of 9.5% from last month and 15.4% from last year.

Average Price: The average price for closed sales is $513.20K, down 7.3% from October and 4.2% from 2024.

Months Supply: The market has a 4.56-month supply of new homes.

Percent of Original Price: New homes are selling for approximately 92.9% of the original list price. This is down 0.6% from September and 2.0% from last year.

Days on Market: Properties are staying on the market for an average of 88 days.

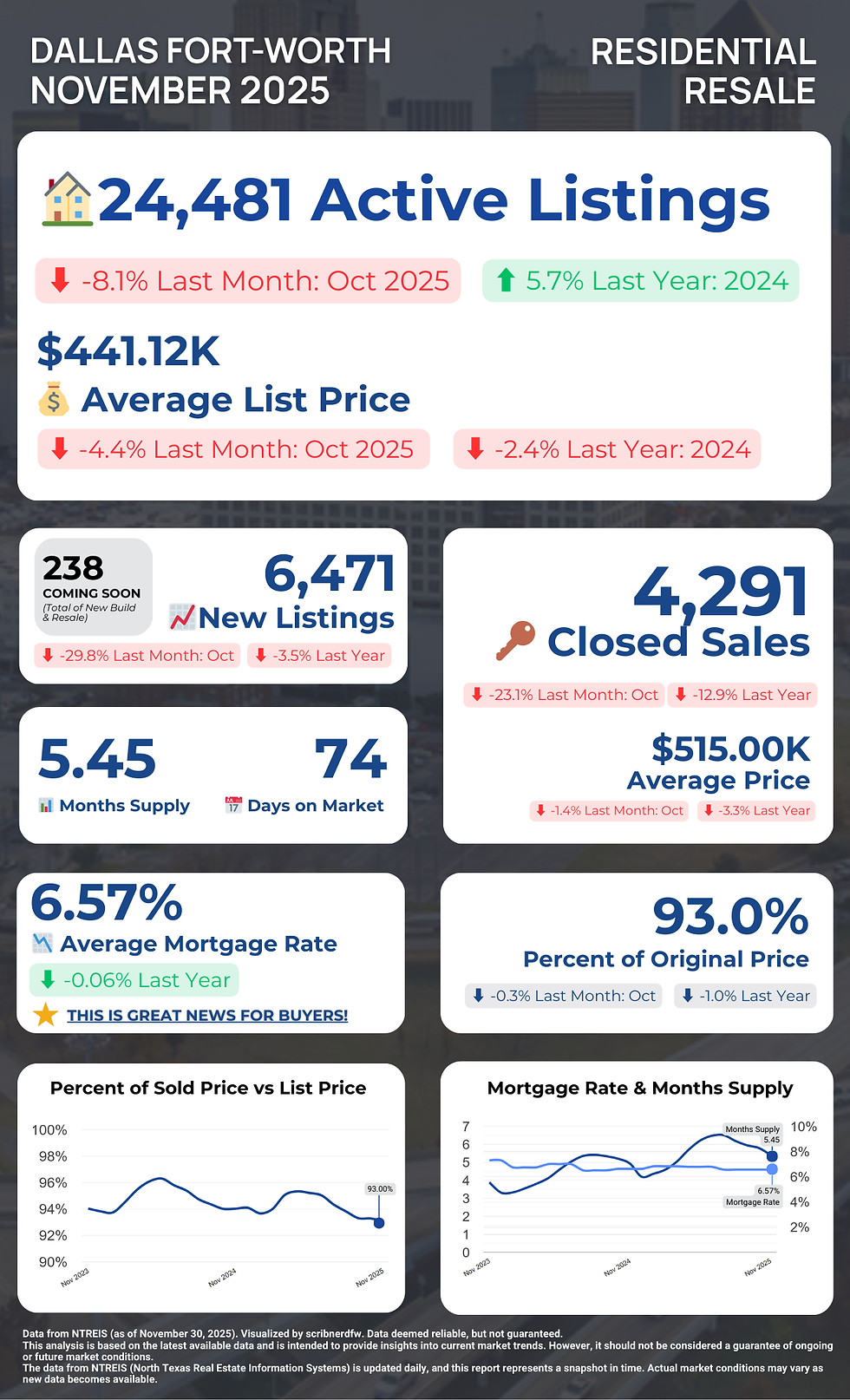

🏘️ Resale Market: Inventory Tightens Monthly, Yet Higher Yearly

The DFW resale market is showing a year-over-year increase in inventory, giving buyers more options than they had in 2024. Active listings stand at 24,481, which is an 8.1% decrease from the previous month but a 5.7% increase over last year. With the months' supply at 5.45 months, the resale sector remains favorable for buyers.

Key Resale Market Trends:

Active Listings: 24,481, down 8.1% from October 2025 but up 5.7% from last year.

Average List Price: $441.12K, down 4.4% from last month and 2.4% from last year.

Closed Sales: 4,291, down 23.1% from last month and 12.9% from last year.

Average Price: The average price for closed sales is $515.00K, down 1.4% from last month and 3.3% from 2024.

Days on Market: Resale homes are taking an average of 74 days to sell.

Percent of Original Price: Sellers are receiving 93.0% of the original list price. This is down 0.3% from October and 1.0% from last year.

c

🔑 Rental Market: More Options for Renters

The DFW residential lease market offers more choices for tenants compared to last year. Active rental listings are at 12,336, a 9.3% increase from last year, though this represents a slight 2.6% decrease from October.

Key Rental Market Trends:

Active Listings: 12,336, a decrease of 2.6% from October 2025 but a 9.3% increase from last year.

Average List Price: The average list price for a rental is $2.37K, a decrease of 1.1% from last month.

Closed Leases: Closed leases totaled 3,423, which is a 13.6% decrease from last month and a 3.3% decrease from last year.

Average Price: The average price for closed leases is $2.50K. This is up 2.2% from October, but notably down 10.21% from last year.

Months Supply: There is a 3.20-month supply of rental properties.

Days on Market: Rental properties are taking an average of 49 days to lease.

Percent of Original Price: Properties are being leased at 95.8% of their original listed price. This is down 0.9% from October and 0.6% from last year.

📈 Overall Market Outlook

The Dallas-Fort Worth real estate market in November 2025 is adjusting to conditions defined by moderated sales activity and price corrections. This shift continues to create great news for buyers, who are seeing lower average prices in both new construction and resale markets compared to last month.

Mortgage Rates: The average mortgage rate is 6.57%, which is down slightly (-0.06%) from last year.

Inventory: Significant year-over-year inventory growth in both the new construction (+4.1%) and resale (+5.7%) markets provides buyers with more options than they had in 2024.

The data suggests a market that is cooling as it heads into the winter months, offering increased leverage for those looking to purchase or lease.

Important Note:

This analysis is based on data from NTREIS (North Texas Real Estate Information Systems) as of November 30, 2025. Market conditions can change rapidly, and this report is intended for informational purposes only. It should not be considered a guarantee of future market performance.